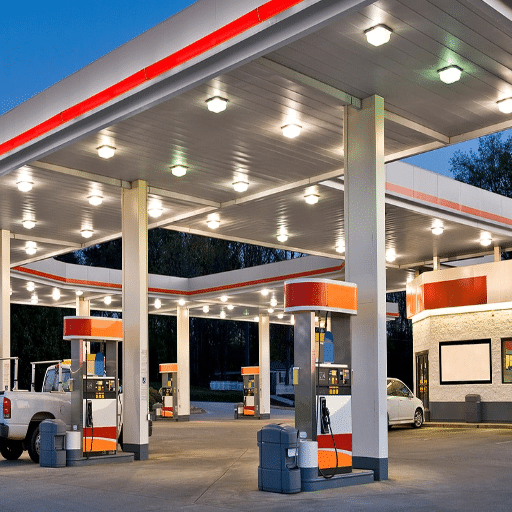

Opening a gas station can be such a lucrative venture, but not without challenges and costs. Prices for land and equipment, permits to operate, operational expenses-all these have to be understood fully under the financial scope before going ahead with the project. This detailed outline walks you through the step-by-step process of opening a gas station, breaking down the cost of opening a gas station, and giving you concrete insights to help plan activities. Are you a budding entrepreneur, or are you in search of high-demand business opportunities? If so, this article will equip you with the knowledge to make sound decisions and ensure the growth of your gas station in the long run.

Understanding Gas Station Startup Costs

Starting a gas station involves considerable upfront expenses that vary based on location, size, and services provided. Generally, the total investment required is between $250,000 and $2,000,000. The main areas of cost are:

- Land Acquisition or Leasing – Land prices vary significantly, with the cost being higher if it is in the urban areas or any area with too much traffic. Leasing can prove to be less expensive.

- Construction and Renovation – This involves constructing the actual station, installation of fuel tanks, and any other facilities that might be provided-under normal circumstances, construction costs will start at $100,000.

- Licensing and Permits – Getting the necessary permits and conforming to local codes can range roughly between $10,000 and $50,000, depending on jurisdiction.

- Fuel Supply Contracts – Advance payment for fuel inventory depends on purchase contracts with distributors, ranging from $50,000 to $100,000.

- Equipment and Infrastructure – A set of fuel pumps, storage tanks, signage, and a point-of-sale system may cost from $50,000 to $150,000.

- Initial Operating Expenses – These concern, to name a few, staffing, security, insurance, and marketing, which require something like $20,000 to $50,000 for a few months.

In this way, an entrepreneur will be able to chart a course for strategic financial planning, freeing himself or herself from those terrible experiences when unexpected financial hurdles crop up during the becoming-a-business process.

Initial Investment Breakdown

Starting a gas station requires a big initial investment, placed mostly anywhere between $250,000 and $2,000,000, depending on factors such as location, size, and business model. Thus, a detailed inquiry of major components follows:

Land and Construction Costs

The price of land for a gas station in the countryside varies from $100,000 to $300,000, while urban locations usually run in excess of $1,000,000. Construction charges have the permit fees and site preparation costs attached to them, and these could add up from anywhere between $300,000 and $700,000 for the building of low or moderately complex designs, depending mostly on the building codes enforced by the jurisdiction.

Fuel Supply Contracts

Allocation of franchise or license fees to brand-name fuel suppliers can run up to $10,000 to $50,000 upfront. An initial purchase of a fuel inventory, however, costs approximately anything from $50,000 to $100,000, depending on the market price for fuels and the storage capacity of the station.

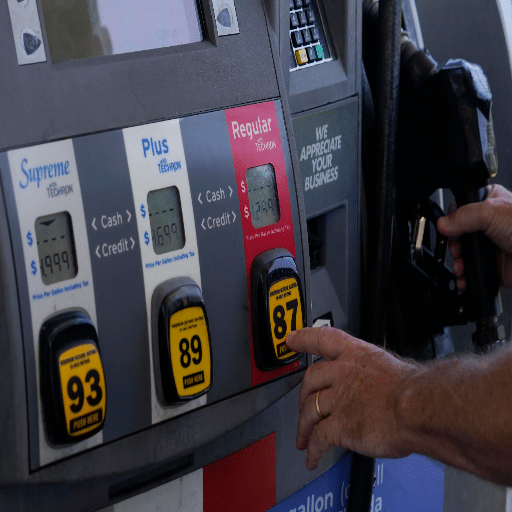

Equipment and Technology

Equipment requires the utmost quality for the efficient running of a gas station. Fuel pumps vary between $15,000 and $25,000 each, while underground storage tanks cost between $50,000 and $100,000. These days, a POS system can be integrated with loyalty and payment processing software, with the whole system costing between $10,000 and $50,000 per station.

Licenses and Permits

Depending on whether the business meets regulatory standards, different licenses must be acquired, such as environmental permits, city registrations of businesses, and certificates of sound fire standards. Such permit issuance prices vary in regions but average anywhere between $5,000 and $20,000.

Working Capital

Having capital in the bank for operational expenses is highly desired to commence operations smoothly. These expenses cover payroll considerations, utility bill payments, preliminary marketing campaigns, and emergencies from $50,000 to $100,000.

Contingency Budget

The experts say for sure that a contingency of about 10-20% of the entire budget ought to be set aside, just in case there are untimely delays or costs. For a medium-sized station, this might translate into anything between $50,000 and $200,000.

Adding all these cost elements together clearly shows that the time and money invested in the station will heavily depend on the scale and customization of the station. A well-researched business plan and proper financial analysis will help ensure a station remains profitable over the long term.

| Cost Category | Estimated Range |

|---|---|

| Land (Rural) | $100,000 – $300,000 |

| Land (Urban) | $1,000,000+ |

| Construction | $300,000 – $700,000 |

| Fuel Pumps (each) | $15,000 – $25,000 |

| Underground Storage Tanks | $50,000 – $100,000 |

| POS System | $10,000 – $50,000 |

| Initial Fuel Inventory | $50,000 – $100,000 |

| Working Capital | $50,000 – $100,000 |

| Contingency (10-20%) | $50,000 – $200,000 |

Key Factors Influencing Costs

Construction and Infrastructure

The physical buildup of a station is a major cost driver, including excavation, concrete works, structural installations, and connection to utilities like water, electricity, sewage, and so on. Costs also vary by the kind of station; whether it is for fueling, EV charging, or something else, as locations, unlike their counterparts in the countryside, are more costly in the urban areas owing to stricter zoning laws and labor costs.

Technology and Equipment

Modern Technologies and equipment, such as smart pumps or EV charging systems, or fuel storage systems, constitute quite a large part of the outlay. The introduction of high-tech components, such as POS systems, safety monitoring systems, or energy-efficient solutions, increases the initial outlay but could curtail subsequent operating expenditures.

Regulatory Compliance and Permits

Meeting all the federal, state, and local regulatory requirements is time-consuming and expensive. These fees include those for permits, inspections, and compliance with environmental or safety standards. The situation may also require additional provisions if the station must install pollution control measures or comply with certain renewable energy provisions.

An all-encompassing assessment of these factors would indeed be necessary to correctly project the budget and to manage the development costs of the station successfully.

Financing Options for Your Gas Station

When financing a gas station, capital can be gained through one of many options. Bank loans are the most common way to secure money, with interest rates usually competitive and repayment terms often longer. A good business plan, good credit, and evidence of potential profitability are generally required for a loan.

Alternative lenders and SBA loans offer entrepreneurs working with specialized lending programs. SBA loans, such as the SBA 7(a), can be used for working capital, equipment, and real estate expenses while providing guarantees to lessen the risk to the lender. The interest rate is usually lower, but stringent qualifications and long processing times are typical.

Another possible way to finance equipment is for business owners to finance the direct purchase of tools needed for their work, such as fuel tanks or point-of-sale systems. Another approach for leasing is to reduce the upfront cost by spreading it over the install. Investors or partners may provide support or operational expertise for those with limited capital or start-up ventures. Evaluating these options and their associated costs, flexibility, and repayment arrangements will be the best fit with the strategic design of the business.

Land Acquisition Expenses

Land acquisition expenses represent a substantial portion of the initial investment required for developing a gas station. The price can vary considerably, depending on location, zoning requirements, lot size, and the condition of the market. Properties in urban locations with heavy traffic characteristics generally hold the higher prices, while rural locations can be relatively more affordable but might come with less demand from customers. Moreover, site assessments, approvals, or environmental regulations could add extra costs; hence, developers must consider these. Others would also desire to analyze costs affecting such site preparation-related activities-destruction, grading, or connection of utilities-building site-to mention just a few. Proper alignment should occur between land acquisition and long-term business goals through an analysis of local market trends and adequate due diligence.

Construction and Infrastructure Costs

Considering Construction and infrastructure costs usually eat up a significant portion of any development budget, including expenses for building materials, labor, and installation work for plumbing, electrical, and HVAC systems. Material costs depend on supplies and demand in the market, with fluctuations in the price of commodities such as steel or lumber affecting the budget directly. Labor costs vary in terms of wages for specific regions, workforce competition, and the complexity of the task at hand. Infrastructure expenses, such as those for roads, utilities, and drainage systems, will differ with the location and scale of the development. Value engineering can be put into practice, while regulatory standards must be followed, to keep construction costs under control and maintain the quality and feasibility of the project.

Equipment and Inventory Expenses

Equipment and inventory expenses are vital considerations in every construction or operational budget, generally constituting a big part of the overall project cost. These costs include buying, renting, or servicing any machinery, tools, or materials necessary to carry out a project. For instance, heavy equipment in the form of excavators, bulldozers, and cranes may be priced anywhere from $100,000 to over $500,000 per unit, depending on the manufacturer, model, and specifications. The rental cost for such machinery, however, ranges between $2,000 and $10,000 per day on average, thus offering more freedom and flexibility for short-term projects.

Inventory expenses include necessary building materials such as cement, steel, wood, and other building materials. Materials cost is so much dictated by the global supply chains and market demand. Lately, the price of structural steel has shown significant variation, estimated somewhere between $600 and $900 per ton. Cement would probably cost anywhere between $125 and $150 per ton, but this is area-dependent and also subject to transportation charges. Inventory strategies’ basis could very well be JIT and bulk buying agreements that cut logistic overhead and reduce cost escalation.

In other words, stakeholders should include equipment and inventory purchasing and planning under proper strategies. Analytics can aid through demand forecasting; scheduling preventive maintenance can extend machinery life; and negotiation can yield opportunities with suppliers. Effective expense management allows a project to proceed on schedule with profit while meeting quality standards.

| Equipment/Material | Cost Range |

|---|---|

| Heavy Equipment (Purchase) | $100,000 – $500,000+ per unit |

| Heavy Equipment (Rental) | $2,000 – $10,000 per day |

| Structural Steel | $600 – $900 per ton |

| Cement | $125 – $150 per ton |

Operational Costs of Owning a Gas Station

Owning a gas station comes with various recurring operational costs. Fuel cost involves the purchase of fuel by station owners from suppliers at wholesale prices and selling it at retail margin. Employee wages constitute a major expense; the staff may be attendants, cashiers, or maintenance personnel. Utilities like electricity for lighting, operation of fuel pumps, and refrigerators constitute a major part of the cost of operations. Property rents or mortgage payments, insurance against a host of liabilities, and property damages are additional financial outgoings. Costs are further increased by regular upkeep of equipment and compliance with environmental standards. Proper cost control in these areas is essential for maintaining profitability.

Monthly Operating Expenses

Monthly operating expenses are recurring costs of keeping an entity up and running. They would almost always include: lease or mortgage payments, utility bills, salaries, marketing expenses, insurance premiums, office supplies, and maintenance costs. Other variable expenses could linger, like shipping, raw materials, or professional services. Having a clear understanding of these expenses will assist in their financial planning and evaluation of profitability and lead to possible cost-saving opportunities. Another obvious rationale for keeping a very accurate record of operating expenses is compliance with tax laws, which further aids in making better decisions on resource allocation.

Staffing and Labor Costs

The staffing and labor costs are sometimes considered the most significant expenses for an organization. Paying wages, salaries, providing benefits, paying payroll taxes, and any other form of compensation are all included in labor costs. To remain competitive despite ever-shifting market standards and industry-specific benchmarks, a firm must provide its employees with fair wages as opposed to its profitability. The other very important factor is whether the workers are classified as independent contractors or employees; incorrect classification of workers can attract penalties, both legal and fiscal. Businesses should also review their staffing at regular intervals to balance operational needs, which in turn dictates higher productivity with no unnecessary expenditures. Keeping a close watch and controlling labor costs can be beneficial to sustainability and growth in the long run for any business.

Maintenance and Utility Costs

Maintenance and utility bills account for operational expenses, which must be prudently managed for efficiency and cost-effectiveness. Maintenance costs may be considered as money spent on repairing equipment, maintaining facilities, and conducting regular inspections to detect imminent breakdowns. Although such occasional maintenance will have short-term expenditure, preventive maintenance will be the key to reducing overall costs, considering that it reduces downtime or increases the useful life of an asset. But on utility costs are electricity, water, heating, cooling, and internet bills. By using energy-efficient measures like lighting with LEDs, HVAC optimization, and energy consumption monitoring, a company may cut utility expenses. Likewise, a periodic review of contracts with utility providers and negotiating better rates will also improve the cost efficiencies. Strategically negotiating the budget between maintenance and utility expenses is essential to ensure smooth functioning and maintain financial stability.

Permits and Licenses Required to Open a Gas Station

Generally speaking, there are several permits and licenses one requires to open a gas station. These may vary according to state and place of operation, but some of the common requirements are as follows.

- Business License: The license to operate the gas station as a commercial entity.

- Zoning Permit: To make sure that the gas station observes all local zoning laws and land use regulations.

- Environmental Permits: They apply to fuel storage, control of spills, and environmental safety standards.

- Underground Storage Tank (UST) Permit: Allows installation and operation of fuel storage tanks. This Underground Storage Tank (UST) Permit is needed for the installation and operation of fuel storage tanks, from an environmental standpoint, to prevent any leakages or contamination.

- Fire Department Permit: To conform with fire safety regulations regarding the storage and handling of flammable materials. Complying with fire safety and hazardous material standards, it sets rules for equipment, storage conditions, and emergency procedures.

- Weights and Measures Certification: Ensures that the fuel pumps and fuel dispensing meet the requirements. It is required in the operation of fuel pumps to ensure fair trade between operators and customers with respect to the alteration of fuel dispensing systems.

- Environmental Compliance Certification: Various jurisdictions require other certifications to ensure that the business complies with air quality laws and environmental safety protocols.

- Local Business Operating License: Typically, a general operating license is granted by local authorities before the start of operations.

Be sure to inquire about any specific requirements that might exist in your area by contacting local state and government offices.

Compliance with Local Regulations

Local regulations must be respected to legally operate a business and foster a relationship of trust within the community. These regulations change from area to area but mostly include necessary licenses and permits, zoning, and health and environmental considerations. The business must ensure it has registered itself with the local agencies and will get inspected by the health and safety authorities, if applicable, among other things. Businesses must constantly check tax obligations in their area. Always check official government websites, consult legal/business advisors, and keep track of any changes that occur with regulations to ensure your complete compliance. Proof of any requirement must be obtained from your local municipal offices to avoid any penalties brought upon or disruption caused to your operations.

Franchise Considerations

While contemplating the prospect of franchises, a few must-have considerations will cement your ultimate decision. First, analyze the franchise’s reputation and track record in the industry; its reputation or standing might oftentimes be set by customer reviews, and it rarely comes into existence in one lifetime. The best franchisors offer their franchisees solid training and an even better support system, sometimes even more important than sales, due to franchisees sometimes never having worked in a franchise before. Also, the franchisee should know the fees, including initial fees, royalty fees, and ongoing franchise expenses, to evaluate his/her investment in relation to its potential return. There is also the territorial right to think about, which asks whether the franchise will have the exclusivity of a certain territory so that it does not have to compete with another branch nearby. Finally, the franchisee should consider whether the franchisor’s business model has been changed over time and adapted to the changes in the market so that the brand can continue to be relevant. These combined constitute the bottom line on which an informed decision could be made on joining a franchise.

Creating a Business Plan for Your Gas Station

Some distilled points to create a gas station business plan would be as follows: Your objectives for the operation should be well defined. Your market should be outlined, considering demographics, location, and local demand for fuel and convenience store items. Analyzing competing gas stations in the area would help provide opportunities and threats.

Secondly, describe your finances, such as financing required, initial investment cost, expected time for profit, projected revenues, operating costs, and risks.

Finally, shed some light on your operational plan, including staff requirements, supply logistics, and daily-running procedures. Also, outline any perks or services your gas station may pride itself on: a car wash, or discounts based on loyalty, all of which set you apart from the competition.

Finally, make sure that your plan involves some form of marketing for customer attraction and retention, like promotions, signage, or partnerships. A more organized business plan is a roadmap for your gas station business and helps in securing loans or investments.

Market Research and Analysis

Local market research is mandatory to understand the environment of the gas stations near your locality. Starting with an analysis of whether there is any fuel demand in the area, keep in mind population density, driving patterns, and how far away the highways are. Identify your target customers-the commuters, truckers, or families-and then analyze their needs concerning fuel economy, convenience, or other facilities.

Look at your competition with their neighboring gas stations with their fuel prices, everyday services, and customer loyalty schemes. While analyzing them, do consider the operators of larger chains as well as independent ones-how they fit the market, or lack. Then, to distinguish from the fiats, notice some trends amongst these stations, like increasing demand for EV charging stations, which may very well be a determining factor for your business.

Finally, be aware of regulations and environmental factors that may operate and cause discrepancies. Find out about zoning regulations, licensing necessities, and the various green projects within the industry. Use all this gathered information to set up your gas station to adequately meet local demands while also differentiating itself from competitors.

Identifying Suppliers and Inventory Needs

Determine suppliers and inventory needs: First, I would research prominent name-brand vendors in the industry offering top-notch fuel at prices fair enough for profit while remaining competitive. Vendors would also be looked for to stock other inventory-toys or oddities, the car care items, snacks, and the like-to have a variety of offerings. Customer preference and local demand should guide us to stock the correct products in the right quantities. Strong relationships with dependable suppliers should assure us of being served promptly and well; negotiating for the best terms should enable efficient cost management.

Financial Projections and Budgeting

Financial planning, projections, and budgeting set the course of any enterprise for success. Using industry benchmarks and expected sales volume, I will gauge revenues and expenses on an expected average profit margin for a manufacturing industry. Fixed costs include rent and utilities, while variable costs can be inventory and human resources. Preparing a realistic budget based mainly on projected cash flow helps to anticipate any possible shortfalls.

The chief industry organizations state that in a competitive market, sustaining a profit margin of 5-15% is indeed possible through cost control and pricing strategies. Budgeting needs to be reviewed regularly and adjusted for shifts in demand or outside influences. Having an emergency fund to draw upon or short-term borrowing options will also ensure financial stability if any unforeseen problems should arise. Finally, simple-to-follow financial measurements should be put in place to track objectives and produce better results as time goes by.

Reference Sources

1. Analysis of Gas Station Financial Management to Prevent Fraud and Anticipate Revenue Fluctuations

2. Strategic Investment Analysis for Gas Station Projects Using Build Operate and Transfer (BOT)

3. Hybrid Power System for a Fuel Station Considering Temperature Coefficient

Frequently Asked Questions (FAQs)

How much does it cost to start a gas station?

The price to open a gas station varies widely depending on location, size, and the type of gas station, really. Initial costs will run anywhere from the $300,000 mark to north of $3 million. This includes buying land, building, permits, equipment, etc.

What are the startup expenses of a new gas station?

The new gas station startup expense will usually include costs of property, construction, gas pumps, tanks, and initial inventory. Then, you also have to take into consideration your ongoing expenses such as utilities, salaries, and fuel supply. These can add up really fast, and this is why you need to have a well-thought-out business plan.

What permits are required to open a gas station?

The licenses and permits you apply for when opening a station include a business permit, environmental permits, and health permits if you want to provide additional services, such as those of a convenience store. Requirements vary from state to state, so you should double-check with the local authorities.

How much does building a gas station cost?

It varies greatly depending on the size of your gas station and the complexity of the construction work. On average, prices range from $500,000 to $2 million for construction, including installation of gas pumps, tanks, and other infrastructure.

How do gas station owners finance their business?

The owners of gas stations mostly finance the business using a combination of personal savings, bank loans, and sometimes financing from the Small Business Administration (SBA). Depending on whether and how you proceed with buying a franchise, franchise fees may also factor into your financing arrangements.

What are the different types of costs that go with running a gas station?

Operational costs for running a gas station include utilities, maintenance, staff salaries, and fuel supply. There may also be costs for inventory, especially if you happen to provide services such as a convenience store.

How does the location of your gas station influence its costs?

The location of a gas station is the most important factor affecting costs and its potential profitability. Prime areas of heavy traffic, especially near major highways, may have extremely high property rates, but such costs are often outweighed by losses in fuel sales and profits from that high rate.

Can you buy a gas station franchise?

Yes, you can buy a gas station franchise, which is typically established by brand names and with some amount of support provided by the franchisor. You, however, would have to analyze the impact of franchise fees and the franchise agreement on your own overall costs and operational strategies.

What are the initial costs for starting a gas station?

The initial costs for starting a gas station business revolve around purchasing or leasing property, construction costs, gas station equipment, and inventory. Very thorough research and planning must be done to know all the potential costs before embarking on this.