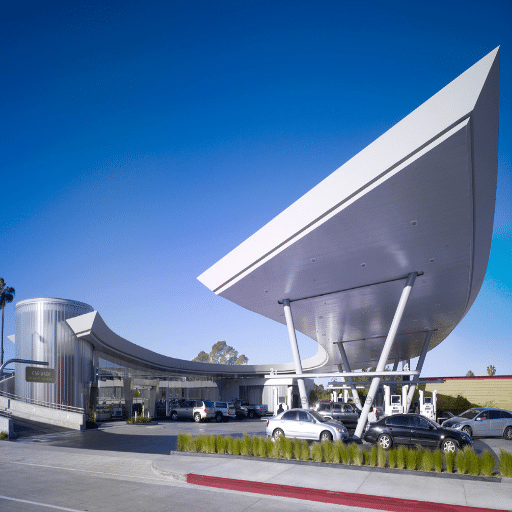

The real challenge with owning and operating a gas station is comprehending all the details required to make it work. They play a crucial role for gas station customers, but they tend to generate very little profit, and their income largely depends on other sources. The profit margins of gas stations are a common misconception, and if understood correctly and dismantled, they reveal a different perspective on this vital sector. In this post, I aim to discuss the factors that impact gas station revenue, explain the profitability puzzle, and share the challenges and opportunities faced by a gas station owner in the current market. I aim to cover all aspects of how gas stations operate, including fuel prices, operating costs, and non-fuel sales, in a single post.

Overview of Gas Station Profit Margins

The profit margin on gas station fuel sales is commonly tight, with the majority of income coming from other sources. The greater part of the income earned from fuel is, on average, allocated to cover expenses such as wholesale pricing, taxes, transportation, and credit card fees, resulting in a minimal net profit margin. To offset this revenue loss, higher-margin sales of snacks, drinks, and automotive services are utilized to increase profits. In the competitive market for sustenance and expansion of a business, this strategic equilibrium is very crucial.

What is the Average Profit Margin for Gas Stations?

Average profit margin on fuel sales

On average, gas stations earn between 1.4% and 3% on fuel sales, a figure that is notably low when compared with other industries. This is indicative of the thin margins gas station operators have to contend with, which include the costs of wholesale fuel, taxes, credit card fees, and transportation. After paying for those hefty costs, the total profit on every gallon of gas sold is only a few cents.

In response to shifts in consumer preferences, many gas stations are also adding electric vehicle (EV) charging points and car washes to their service offerings. This not only caters to the consumer’s needs but also helps create multiple sources of income.

How Much Do Gas Stations Make?

The profit a gas station makes depends on several factors, including its location, fuel prices, additional services it offers, and the number of customers it attracts. Typically, fuel stations earn a net margin of around 1.4% to 3.0% on gasoline sales, due to the highly competitive market and frequent fluctuations in crude oil prices. However, non-fuel sales are the most profitable for gas stations. For example, items in convenience stores generally have higher profit margins, with snacks and drinks typically having margins ranging from 30% to 50%.

Car washes, repair shops, and increasingly popular EV charging stations also enable gas stations to have multiple streams of income. Some stations in smaller towns or rural areas can earn between $250,000 and $2 million per year. In contrast, in highly trafficked metropolitan areas, their revenues can surpass $5 million. Stations that offer popular foods or specialty products tend to perform better than those that sell only fuel, which makes ancillary offerings another vital aspect of increased profitability.

| Location Type | Annual Revenue Range | Key Revenue Drivers |

|---|---|---|

| Rural/Small Towns | $250,000 – $2 million | Basic fuel, convenience items |

| Metropolitan Areas | $5+ million | High traffic, premium services |

| Highway Locations | $3-7 million | Travel fuel, food service |

Factors Affecting Profit Margins

Profit margins in gas stations and EV charging stations depend on several elements such as location, customer base, prevailing market conditions, and operational effectiveness.

Location and Traffic Volume

Being in the city entails a lot of foot traffic. With more foot traffic, the sales of fuel and even EV charging go up, making the town even more profitable (think sales). In fact, with the right mix of demand-driving services such as convenience stores or branded coffee shops, some metropolitan gas stations have achieved an astonishing 25% profit margin.

Fuel Pricing Strategies

Pricing is one of the factors that influences profit margins. The need to compete often leads to discounting. Discounting, however, brings along the trade-off of reduced overall profit per gallon and lower volume of sales. Discounting, for instance, a profit of 5-7 cents per gallon can lead to substantial profits given sufficiently high traffic.

The Rise of EV Charging Infrastructure

The rise of electric vehicles opens up a new set of opportunities for charging service stations. These opportunities are especially well-suited for premium fast-charging services, which can be offered at rates of $0.25 to $0.40 per kWh. The addition of EV infrastructure is estimated to boost station revenues by 10-15% annually in areas with advanced electric vehicle adoption.

Ancillary Products and Services

Introducing freshly prepared food, car wash services, or branded merchandise can significantly contribute to the bottom line. It’s a fact that gas stations with convenience stores generate close to 30% of their total revenue from food and beverage sales, which typically come with a profit margin of over 50%.

Managing Operational Costs

The way operational costs are managed, from energy usage to employee shifts, affects profit margins. Utilizing energy-saving devices and modernized point-of-sale systems reduces costs and enhances profitability.

Gas and EV stations stand to benefit from continually fine-tuning their profit strategies amid shifting automotive trends, customer expectations, and preferences.

Revenue Streams for Gas Stations

- Fuel Sales: The core revenue for gas stations, which comes from the sale of gasoline and diesel, is supplemented in some instances by the sale of alternative fuels such as compressed natural gas or hydrogen.

- Convenience Store Sales: Many gas stations generate significant income through convenience stores, offering a range of items including snacks, beverages, tobacco products, and essential groceries.

- Car Wash Services: Providing quick car wash services adds an extra source of income for gas stations, as many customers appreciate the convenience of on-site vehicle cleaning.

- Auto Maintenance Services: For example, offering oil changes, tire inflation, and basic engine check services to customers provides additional revenue while also serving diverse needs.

- Partnerships and Advertising: Additional income sources are brought by branded promotions, sponsorships, or billboard advertisements, which in turn help fuel station marketing.

Gas stations can ensure growth and remain profitable in the long run by leveraging the income from these different sources.

Gasoline Sales and Profitability

The sale of gasoline generates the bulk of a gas station’s revenue, but the margins on other goods sold there can be significantly different. Fuel, especially gasoline, is a high-demand commodity; however, its profit margins are modest. Gas stations, on average, earn only a few cents of profit for each gallon of fuel sold, and that small amount of profit must cover operational expenses, taxes, and the cost of the fuel itself. Consider the United States, where the average gross margin on a gallon of gasoline is roughly 15 to 20 cents. Expenses, such as staffing, utility costs, and fees from credit card transactions, tend to take a significant bite out of that margin, in addition to overhead costs.

Average gross margin per gallon in the US

The profitability of gasoline is almost always tied to the prices of refining and crude oil. Additionally, the price-cutting wars in local markets further erode the already low margins. To overcome such issues, many gas stations attempt to generate more foot traffic for their convenience stores or increase revenue from the supplementary services mentioned previously. In the U.S., approximately 44% of gas station profits come from retail and ancillary services, demonstrating the importance of diversification to remain profitable amid constant changes in fuel markets.

Convenience Store Sales as a Revenue Source

Sales generated from convenience stores have become a key profit centre for gas stations, especially when facing unstable fuel prices. Industry reports show that such stores are major income centers, with beverages, snacks, tobacco, and ready-to-eat foods being the primary revenue drivers. In 2022, in-store sales contributed $277.9 billion to the revenue of convenience stores in the US alone, as cited by industry reports. Beverages, both alcoholic and non-alcoholic, stand out as high-performing items, accounting for nearly 20% of the sales. Other fast-moving items, such as candy and ready-to-eat foods, continue to capture consumer attention due to their easy grab-and-go convenience.

Additionally, gas stations are adopting new technologies, such as loyalty programs and mobile ordering, to enhance convenience store purchases. Not only do these new programs drive revenue, but they also enhance customer loyalty and stickiness. The transition from fueling to shopping has proven to be an effective pump-to-store promotion, as customers frequently purchase additional items during this process. The increasing demand for healthier snacks and premium coffee is met with evolving inventory as gas stations strive to cater to the constantly changing preferences of consumers, ensuring continued growth in this vital revenue channel.

Diversifying Revenue Streams

To meet shifting consumer expectations and remain competitive, gas stations are searching for new revenue opportunities. One notable method is the adoption of electric vehicle (EV) charging stations. Given the forecasted compound annual growth rate of 23.1% globally for the EV market from 2023 to 2030, gas stations stand to benefit from installing charging infrastructure as they seek to widen their customer base to include environmentally conscious and tech-savvy customers.

Projected global EV market CAGR (2023-2030)

Another significant diversification track is the foodservice sector. Research shows that convenience stores offering food service, including freshly made sandwiches, salads, and gourmet coffee, experience 20% higher sales compared to those offering traditional prepackaged food. This trend is fueled by consumers seeking healthier quick-service meal options during brief stops.

Moreover, partnerships with delivery and digital platforms have created new revenue opportunities for gas stations. Increasing store visibility and sales, particularly during slow periods, customers can conveniently purchase in-store products through various apps. According to reports, the convenience store sector, driven by digital ordering, is projected to exceed $360 billion globally by 2030.

With the adoption of these approaches and aligning with industry shifts, gas stations stand to gain both in terms of revenue and sustainable growth, all while meeting the needs of today’s market.

The Impact of Gas Prices on Profit Margins

The profit margins of a gas station vary significantly with the price of gas, as fuel sales account for a substantial share of the station’s revenue. Consumers are likely to reduce driving when fuel prices increase, leading to a drop in fuel demand. This decline can reduce net profits, especially for gasoline-reliant gas stations. Fuel demand is likely to rise with lower gas prices, but it can lead to thinner margins due to the need for competitive pricing. Many gas stations mitigate these risks by increasing non-fuel sales, such as snacks, drinks, and other convenience products, which typically have much better profit margins. This approach lessens the adverse effects that frequent fuel price changes have on gas stations.

Understanding Gas Prices in the Market

As a whole, fuel prices are impacted by global crude oil prices, regional supply and demand, and government taxes or regulations. For instance, the prices of crude oil, a major component of fuel costs, are influenced by geopolitical events, production restrictions from organizations like OPEC, and general market trends. A sudden increase in prices, for instance, can result from geopolitical conflicts or natural disasters in key production zones.

The supply and demand in a particular region are also essential. Regions undergoing disruptions to the supply chain, issues with refining capabilities, or demand surges, such as during the summer months when there is increased travel, tend to have higher fuel prices. In the third quarter of 2023, U.S gasoline prices increased 10% as a result of a lack of refineries in some areas and a surge in travel in the summer.

Government policies and tax structures also influence pricing. States like California, which impose higher gasoline excise taxes, not only face increased prices themselves but also have prices that are higher on average. In addition, consumer costs may also be indirectly affected by refinery costs due to policies aimed at promoting low-carbon fuels and renewable energies.

According to recent national averages, the average price per gallon in the U.S. was approximately $3.85 in September 2023, indicating a slight decline from the summer peak. However, such changes can be significantly influenced by the specific area and other external conditions. Recognizing these elements highlights the complexities associated with gas pricing and underscores the importance of careful management for both individuals and businesses.

How Gas Prices Affect Retail Gasoline Profit

The price of retail gasoline largely determines the profit margin of gas stations. Still, it is influenced by a range of other factors, including the price of crude oil, refining costs, distribution and marketing expenses, and taxes. With an increase in the price of crude oil, the profit margin of retailers tends to shrink as market competition forces them to minimize the rise in prices payable by consumers. The Stanford GSB report of 2022 states that the average gasoline gross margin in the United States is between 10 and 15 cents per gallon, which varies greatly depending on the region and operating costs.

In the last few years, the refining costs have also changed drastically, as refining capacity has struggled to meet demand during peak periods. For instance, September 2023 reports show that refining outages and upkeep caused an increase in wholesale gasoline prices. At the same time, stations also have to deal with other operating costs such as wages, utilities, and inventory management, which also affect the bottom line.

Conversely, when wholesale gasoline prices fall, certain retailers may stand to gain from increased profit margins if they delay adjusting pump prices downward. This pricing tactic can enhance the short-term bottom line in competitive markets where brief lags in price changes are the norm. The situation is also influenced by geography. States with steep gas taxes or areas with remote access to markets typically have higher pump prices for consumers. This can be both advantageous and difficult for retailers. Ultimately, retail gasoline prices and profitability will likely be determined by the interplay of consumer demand, operating costs, competition levels, and the dynamics that govern the retail gasoline industry.

Strategies to Manage Fluctuating Gas Prices

Adopting Fuel Hedging Practices

Hedging fuel is a strategy in which a fuel retailer secures fuel prices by entering into agreements and other financial contracts at a predetermined price. For example, businesses can use futures and options to lessen the impact of fluctuating fuel prices. This fuel procurement method shields a business from unpredictable spikes in fuel prices, allowing the company to have more predictable business expenses.

Improving Supply Chain Logistics

Changes to gas prices can be significantly mitigated with proper supply chain management. A thorough analysis of route optimization and the utilization of advanced logistics software can be a significant aid in reducing fuel and transportation expenses. A case study has shown that firms adopting strategic fuel purchasing and distribution policies for fuel procurement witnessed reduced operational costs of up to 10 percent. Supplier diversification, combined with the strategic use of their geographical locations and rationing of deliveries, can also mitigate the impact of a gas price increase.

Investing in Energy Efficiency and Alternative Fuels

Implementing newer energy-efficient technologies is an alternative to fossil fuel consumption, and it is gaining traction. The use of electric or hybrid vehicles is a prime example, and they provide cost savings on a long-term scale when compared to conventional cars that rely on fuel. The shift towards alternative fuels also holds considerable promise for a solution to the ever-increasing gasoline prices. This, along with a move towards renewable energy, provides a shift towards a global sustainable approach at optimized costs.

Dynamic Pricing Models

Retailers can adopt dynamic pricing models to respond to current market situations due to the availability of advanced business analytics. In determining the optimum price, real-time data may be utilised to evaluate the profitability and competitiveness of the product. It is well-documented that businesses employing the dynamic pricing model experience improved profit margins, even when the market is volatile.

Greater Store Features to Generate More Revenue

Retailers can mitigate the effects of changing fuel prices by offering a broader range of non-fuel products. An example includes expanding the scope of car washes or retail food services to create additional income channels. According to the National Association of Convenience Stores, an assortment of high-margin products, including coffee and cooked foods, is a substantial driver of profitability.

Tracking Customer and Market Behavior

Anticipating price changes and early strategic adaptations can be done using consumer and market data. Recent industry publications have indicated that utilizing market intelligence software and consumer data analytics enables petrol retailers to fine-tune their operations and adjust pricing models in response to uncontrollable changes in gasoline prices.

By implementing the measures above, a company can reduce the negative impact of rising and falling fuel costs, continue to turn a profit, and enhance its structural integrity in an ever-evolving business environment.

Calculating Average Revenue and Margins

Average revenue is average income per unit, so to calculate it, one should divide total revenue by the number of units sold. The formula is:

The profit margin is calculated as the difference between total revenue and total cost, divided by total revenue, and then expressed as a percentage by multiplying by 100. The formula is:

Leveraging such metrics enables companies to assess their financial performance and identify areas for potential profit improvement.

Average Gas Station Revenue Analysis

Fuel represents the most significant source of revenue for gas stations; however, shops and service stations can earn more through snacks, soft drinks, and other convenience store items, as markups on fuel products are low and fiercely competitive. In fact, snack bars tend to offer the highest markups.

Recent data show that, depending on the location and its catchment, a single gas station can earn between $100,000 and $500,000 per year through convenience store sales. Fuel sales bolster revenue, with some stores selling thousands of gallons of fuel weekly. To illustrate, fuel purchases in the range of 4,000 to 5,000 gallons daily, where the fuel price averages $3.50 per gallon, translate to a gross revenue of over $5 million per year.

Fueling revenue, in addition to ancillary services like car washes, can generate an extra $30,000 to $70,000 per year for stations offering such services. The revenue potential is greatly influenced by the station’s location, traffic, and proximity to highways. Moreover, additional services such as lottery ticket sales or partnerships with delivery services can generate further revenue streams. Knowledge of these streams can help owners tailor financially effective strategies.

| Revenue Stream | Annual Revenue Range | Profit Margin |

|---|---|---|

| Convenience Store Sales | $100,000 – $500,000 | 30% – 50% |

| Car Wash Services | $30,000 – $70,000 | 40% – 60% |

| Fuel Sales (5M gallons/year) | $5+ million | 1.4% – 3% |

Margin on Gasoline: What to Expect

Various factors, such as geographic location, operating costs, and market demand, can significantly influence the gas margin. The owners of gas stations typically make around five to fifteen cents per gallon. Nevertheless, this figure represents the gross margin, which is usually only a small fraction of the total revenue. Other operating costs, such as rent, employee wages, utilities, and credit card fees, also need to be paid, and they contribute to the decrease in the net profit. Fuel such as premium and diesel generally yields higher margins than regular fuel. Margin rates are also influenced by competition and changes in fuel prices. To increase their margin, ancillary services such as convenience store sales and car washes are essential for gas station owners. In fact, those services have much higher profit margins than fuel.

Comparison of Profit Margins Across Fuel Retailers

Profit margins in the fuel retail industry depend on and are heavily influenced by the business model, the location, and the services offered. On average, fuel stations make lie between 5 and 10 cents per gallon of fuel sold after paying out rent, taxes, and operational costs. Fuel stations that operate as chains or larger retailers may have slightly better margins, as they benefit from economies of scale and discounts offered for bulk fuel purchases. On the other hand, independent stations may have more rigid margins as they face local competition and higher wholesale prices.

Fuel retailers, whether chains or independents, rely on other streams of revenue to offset the often minimal profits from fuel sales. Fuel station convenience stores generate substantial revenue through the sale of snacks, drinks, and basic groceries, which are typically marked up at a higher rate than fuel. Similarly, the addition of car washes and vehicle repairs greatly improves the total revenue. In addition, stores in urban settings with higher traffic experience better revenue and profit margins due to the larger number of customers and steady demand for fuel, in contrast to stores in rural settings with lower traffic.

| Retailer Type | Fuel Margin (per gallon) | Advantages | Challenges |

|---|---|---|---|

| Chain Retailers | 8-12 cents | Economies of scale, bulk purchasing | Corporate overhead, standardized pricing |

| Independent Stations | 5-8 cents | Flexibility, local relationships | Higher wholesale costs, limited resources |

| Urban Stations | 6-10 cents | High traffic, convenience premium | High real estate costs, intense competition |

| Rural Stations | 8-15 cents | Less competition, community loyalty | Lower volume, higher operational costs |

Tips for Boosting Gas Station Profit Margins

- Increase Sales in Convenience Stores: Focus on snacks, soft drinks, and ready-to-eat meals, all of which have high profit margins. Adjust stock regularly to match customer demand.

- Start a Loyalty Program: Create a points or rewards system to boost repeated purchases both at the pump and inside the store.

- Include Additional Services: Consider offering car washes, car servicing, and even electric vehicle charging, all of which could generate new revenue streams.

- Improve Operational Efficiency: Cut costs by maintaining machinery, renegotiating supply deals, and utilizing energy-saving devices such as efficient lighting and appliances.

- Use the Location to Your Advantage: For locations with high foot traffic, increase visibility by utilizing signage, cross-store promotions, and advertising to attract more customers.

Gas stations can improve profits and remain competitive by addressing the issues outlined above.

Effective Marketing Strategies

Effective marketing strategies for gas stations can be developed by:

Rewards Programs

To boost repeat business, develop a customer rewards program. After a certain number of purchases, customers can receive discounts, points, or even free items, which helps in gaining their loyalty and trust.

Social Media and Digital Marketing

Special offers and events can be advertised using social media and other online advertising channels. Geotargeting can be used to drive customers in the vicinity to visit the store.

Community Involvement

Provide value to the community by sponsoring local events or supporting local causes. This can help nurture a positive image and loyalty to the brand.

Promotions on Site

Use bundling and offer well-known snacks and beverages, as well as car wash vouchers, and advertise them with attractive signage. This will increase convenience while increasing sales.

Mobile Apps and Payment Systems

Develop a proprietary mobile app for your rewards program, fuel discounts, and payments. Contactless payments should also be supported to streamline costs and reduce expenses.

Enhancing Customer Experience in Convenience Stores

To enhance the customer experience at a convenience store, I focus on creating a warm environment with tidy and well-organized areas, courteous employees, and prompt assistance. Additionally, I strive to offer a diverse and high-quality assortment of products, including fresh food and other daily essentials, that customers seek. Fresh and daily need products concern the customers. Self-checkout kiosks and mobile payment methods are examples of technology that I use to enhance the speed and ease of shopping further. I utilize loyalty schemes and tailor-made offers to not only deepen the relationship but also encourage further shopping.

Leveraging Technology for Increased Efficiency

The technology advances in retail do not only involve automation and data analytics but also extend to customer-facing tools. For instance, increasing stock while decreasing manual labor is a key benefit of automated inventory management systems. With data analytics, it is possible to evaluate consumer and purchasing trends, enabling the advanced streamlining of marketing, stocking, and even personalization. On the user side, mobile payment systems and self-checkout kiosks help speed up the checkout process, thereby reducing queues. Furthermore, the use of mobile apps and AI chatbots not only equips the business with enhanced technology tools but also improves user functionality at the same time. As shops adopt these technologies, they not only enhance their business but also reduce operational costs and offer more benefits to their customers.

Reference Sources

1. Stock Portfolio Selection Based on Factors of Market Capitalization and Profit Margin

3. Model of Control of Financial Results of the Enterprise

Frequently Asked Questions (FAQs)

What is the profit margin on average for gas stations?

The profit margin at gas stations is typically around 2-3% on fuel sales, but it can vary significantly by location and operational efficiency. The margin on fuel sales is low, but is supplemented by sales from the convenience store, which tends to have higher margins. Yet, considering convenience store sales, profitability still tends to be negative due to fluctuations in gas prices and operating costs.

What other revenue streams can gas station owners tap into?

Gas station owners can increase their revenue streams by adding a convenience store, offering food and beverage sales, providing car washes, and offering maintenance services. Offering more and better services to customers, as well as running discount campaigns, can significantly increase their profits, fueling sales growth alone.

What are the profit margins on fuel sales for gas stations?

Gas stations typically make little profit on fuel sales, earning an average of 5 to 15 cents per gallon. Convenience store items and other revenue streams are crucial in helping to increase the station’s profitability.

How much do gas stations make from convenience store sales?

Many gas stations heavily depend on their convenience stores to generate revenue, as profit margins of 20-30% are standard, while fuel profit margins can be very low. Because sales of fuel are heavily discounted due to competition and fluctuating wholesale prices, convenience store sales become the primary source of revenue for many gas stations.

What is considered to be a gas station’s profit center?

The profitability of gas stations, including fuel sales, is influenced by several factors, such as location, gasoline prices, competition, and operating expenses. The ability to provide fuel discounts and the quality of the overall customer experience may also enhance revenue and the net profit margin on fuel sales.

How do changes in gas prices affect gas stations’ profit margins?

Gas price changes directly affect the profit margins of gas stations. Fuel price surges can increase costs, thus squeezing margins. To remain profitable, gas stations must optimize their pricing and manage operating costs efficiently.

What must one keep in mind when opening a gas station?

When opening a gas station, the key issues to address are selecting the appropriate location, securing startup capital, and managing operating expenses. In addition, diversification of income, knowledge of fuel marketing, and the average revenue that can be generated from fuel and C-store sales are paramount.

How do oil companies impact gas station profitability?

Since oil companies control wholesale gasoline prices, they have a direct impact on the profitability of gas stations. Gas stations need to have a sound relationship with oil companies because, without good relations, maintaining competitive pricing alongside decent profit margins becomes impossible. To enhance profits, possessing good knowledge of the gasoline market and practical negotiation skills is essential.

What can gas stations do to increase profits?

Gas stations can enhance the customer experience by offering fuel services from multiple brands, employing friendly and helpful staff, and maintaining a clean and well-organized fuel station. Gas stations can also run promotions and loyalty programs, along with offering necessary items from the convenience store, to increase foot traffic and sales, and ultimately, increase profits.